Seven LeBron-Bronny moments from Lakers preseason that led to NBA history

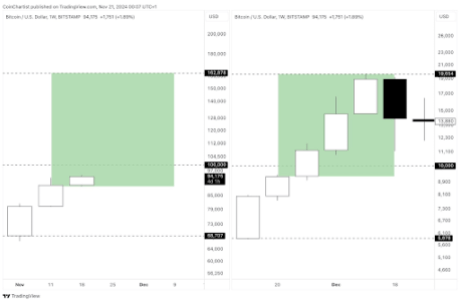

The Blockchain Association has urged President-elect Donald Trump to take immediate steps to bolster the US crypto industry during the first 100 days of his term, according to a letter sent on Nov. 22

The association’s proposals center on establishing a comprehensive regulatory framework for digital assets, ending discriminatory banking practices against crypto firms, and appointing new leadership at key federal agencies, including the Securities and Exchange Commission (SEC) and the Treasury Department.

The group, representing over 100 firms from the crypto industry, added:

“We stand ready to work with you to ensure the United States can regain its position as the crypto capital of the world.”

Five-point letter

The Blockchain Association underscored the importance of bipartisan legislation in defining precise rules for market structure and stablecoins. It argued that a fit-for-purpose framework is essential to foster innovation while protecting consumers.

Additionally, the association added via an X post that Congress must lead the crypto legislation efforts, providing long-overdue clarity and consistency, enabling the U.S. to unlock the next wave of financial innovation.

The letter highlighted the widespread issue of “debanking,” where banks deny crypto companies access to traditional services critical for payroll, vendor payments, and taxes. This practice has stifled the growth of legitimate businesses and hampered US competitiveness.

For example, Coinbase found in early November that the Federal Deposit Insurance Corporation (FDIC) was advising banks to curb their banking services to crypto firms.

Moreover, the crackdown on crypto companies stemmed from Operation Chokepoint, the title given to the set of actions against the blockchain industry during President Joe Biden’s administration, also includes enforcement actions against crypto-friendly banks.

The association called for an immediate end to this discrimination, enabling the sector to thrive on equal footing. It also urged an end to the current “regulation-by-enforcement” approach, which has created uncertainty and deterred innovation.

Specifically, it called for the rollback of SAB 121, an accounting guideline seen as punitive to crypto businesses, and demanded a more transparent, innovation-first regulatory environment.

It also requested the appointment of a new SEC chair to replace Gary Gensler, who announced that he would leave his role on Jan. 20. Trump has yet to name a replacement and some candidates have reportedly refused to take the post in recent days.

The association also asked for clarity on crypto taxes, urging a reset of Treasury and IRS policies on digital assets, particularly the Broker Rule.

It warned that overreaching tax proposals could drive promising companies offshore. Additionally, the group emphasized the need to support developers and protect the privacy of American citizens in the evolving digital economy.

Lastly, the Blockchain Association proposed creating a public-private advisory council to ensure balanced and effective policymaking. This body would collaborate with Congress and regulatory agencies to craft pragmatic, fit-for-purpose regulations that benefit the industry and consumers.

Leadership at risk

The letter framed these priorities as critical to reversing what it described as years of hostile regulation that drove innovation offshore. By addressing these issues, Trump’s administration could signal a clear commitment to making the U.S. a global leader in blockchain technology.

As other nations race to attract blockchain innovation with crypto-friendly policies, the U.S. risks falling behind without decisive action.

The Blockchain Association urged Trump to seize the opportunity to establish a leadership position and ensure that the next era of financial and internet innovation is built in America.

With these five priorities at the forefront, the Blockchain Association envisions a regulatory reset that balances innovation with consumer protection, helping the US reclaim its status as a global hub for crypto and digital assets.