Seven LeBron-Bronny moments from Lakers preseason that led to NBA history

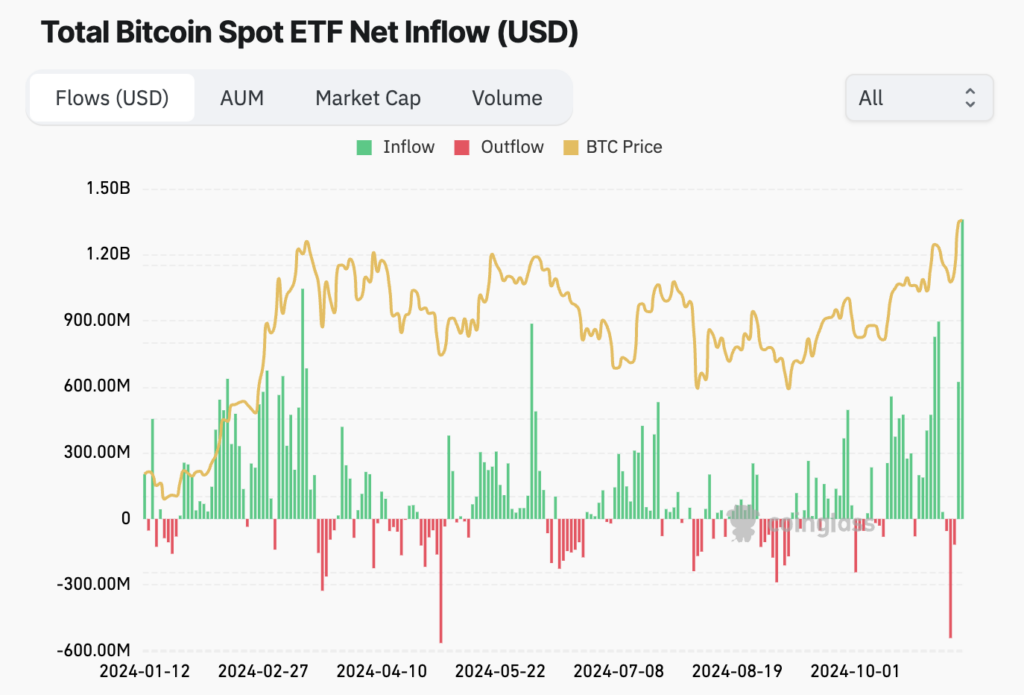

BlackRock’s IBIT recorded a historic inflow of $1.12 billion on Nov. 7, surpassing previous combined totals for all spot Bitcoin exchange-traded funds. This significant capital movement marks the largest single-day inflow in the history of spot Bitcoin ETFs.

Other major asset managers also reported notable inflows. Fidelity’s FBTC received $190.9 million, while Bitwise’s BITB increased by $13.4 million. Ark’s ARKB gained $17.6 million on the same day, according to data compiled on Nov. 7. The combined inflow hit $1.37 billion, marking the best day in spot Bitcoin ETF history since they launched in January.

These inflows coincide with Bitcoin breaking the all-time high several times to a peak of $76,900, breaking previous records twice since the US presidential election on Nov. 5. The surge in Bitcoin’s price and ETF inflows suggests increased institutional interest following the election results.

The ETF’s unprecedented inflow outpaced the previous combined total for all similar funds, signaling a potential shift in institutional investment strategies following Trump’s win.

The post BlackRock sees historic $1.1 billion inflow as spot Bitcoin ETFs have best day ever appeared first on CryptoSlate.