Seven LeBron-Bronny moments from Lakers preseason that led to NBA history

This article is also available in Spanish.

In his latest video analysis titled “I Just APED Into This Hidden RWA Altcoin Gem! [20x Potential],” prominent crypto analyst Miles Deutscher unveiled Chintai (CHEX) as his latest high-conviction investment within the Real World Assets (RWA) sector. Deutscher believes Chintai could offer significant upside potential—up to 1,900% (20x)—in the upcoming market cycle.

Deutscher has consistently highlighted RWA tokens as one of his top investment narratives, ranking third behind memecoins and AI for this crypto bull run. “When I look at narratives that can actually change the fabric of crypto and really offer a new value add, I think RWA is massive,” he stated. He emphasized the growing appeal of on-chain treasury yields, especially as traditional decentralized finance (DeFi) yields diminish and interest rates decline.

The analyst previously capitalized on early investments in ONDO and Mantra (OM), both of which have seen substantial gains. ONDO, for instance, delivered a 7x return from his initial entry point. However, Deutscher now considers these assets to be reaching overvalued territories. “Valuation-wise, though, it’s pretty insane considering the fact that its market cap’s a billion, but it’s fully diluted valuation (FDV) is $7.1 billion,” he said regarding ONDO.

Related Reading

Deutscher has been reallocating his capital into what he perceives as undervalued opportunities within the RWA space. Alongside Clearpool (CPOOL), which he mentioned has already gained 42% since his initial disclosure, Chintai (CHEX) stands out as his newest and largest RWA position. “This one I’m also really, really bullish on. It’s tough for me to say if I’m most bullish on this, but it might be the one that I’m most bullish on in the RWA sector,” he remarked.

Chintai differentiates itself by being one of the few RWA-focused layer-one blockchains regulated by the Monetary Authority of Singapore (MAS). “If you know Singapore, they are so strict with due diligence. It’s really hard to get a license; they fought for a license and they’ve got it,” Deutscher noted. This regulatory approval positions Chintai to attract significant institutional capital, potentially channeling billions of dollars in total value locked (TVL) onto their chain.

The analyst highlighted Chintai’s robust fundamentals, including its extensive list of major clients and partnerships, such as DHC, Finstable, and Greengate. “They are basically a marketplace for tokenization, an L1 blockchain for RWA tokenization,” he explained. The platform has already facilitated over $630 million worth of loans and is set to launch “OZEAN,” a blockchain for RWA yield supported by Optimism, early next year.

Related Reading

From a valuation perspective, Deutscher sees substantial upside potential. Chintai currently has an FDV of approximately $250 million, significantly lower than Mantra’s $1.37 billion FDV. “If CHEX—even in a static market without the market growing at all—does a 6x, that’s just now matching Mantra,” he calculated. Considering the potential growth of the RWA market, the upside could be even more pronounced. “What if the RWA market 2x’s? Because I think it’s going to be a very strong narrative next year; then you could be looking at a 14x.”

Despite its strong fundamentals, Deutscher acknowledges that Chintai’s lower valuation compared to its peers is largely due to a lack of market awareness. “Why is there that discrepancy despite the fundamentals being just as, if not more strong, for Chintai? Just marketing,” he observed. Mantra has excelled in marketing efforts, attracting considerable attention in the crypto community. “Once Chintai can improve its awareness—and I’m actually giving it more awareness by making this video—that is the only key that it’s missing.”

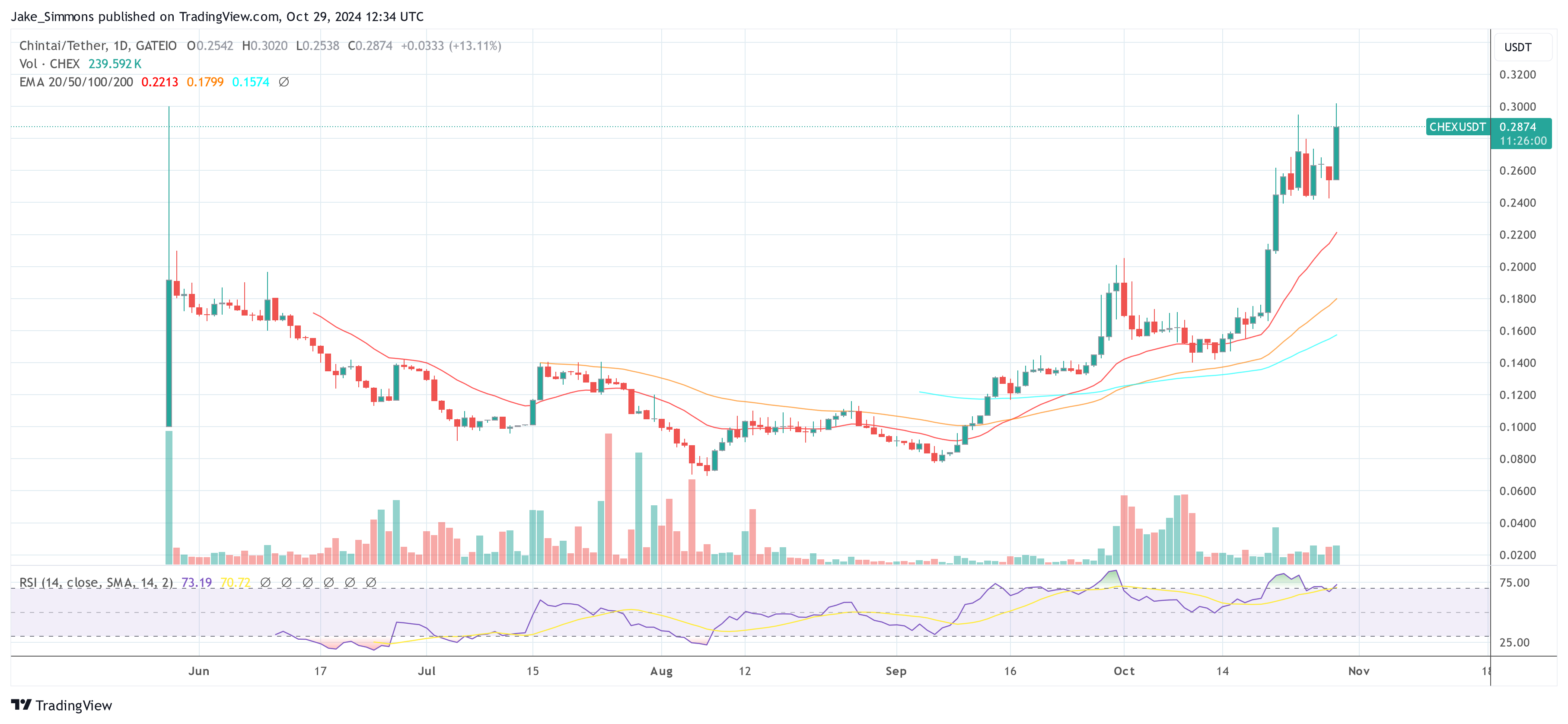

On the technical front, Deutscher finds Chintai’s chart promising. “What I also like from a technical analysis perspective is the fact it’s hovering above this zone, which, if you are technically inclined, you have that technical invalidation,” he said, pointing out the potential for a significant move to previous highs. He remains cautiously optimistic about price targets, emphasizing prudent profit-taking strategies. “I don’t want to get carried away with crazy price targets… I’m never greedy in this market.”

Deutscher concludes that Chintai’s combination of regulatory compliance, institutional appeal, and undervalued status makes it a compelling investment. “They can actually attract institutional capital because of the licensing and because of the product they’ve built,” he affirmed.

At press time, CHEX traded at $0.2874.

Featured image created with DALL.E, chart from TradingView.com